Research Brief: Inflation – March 2024

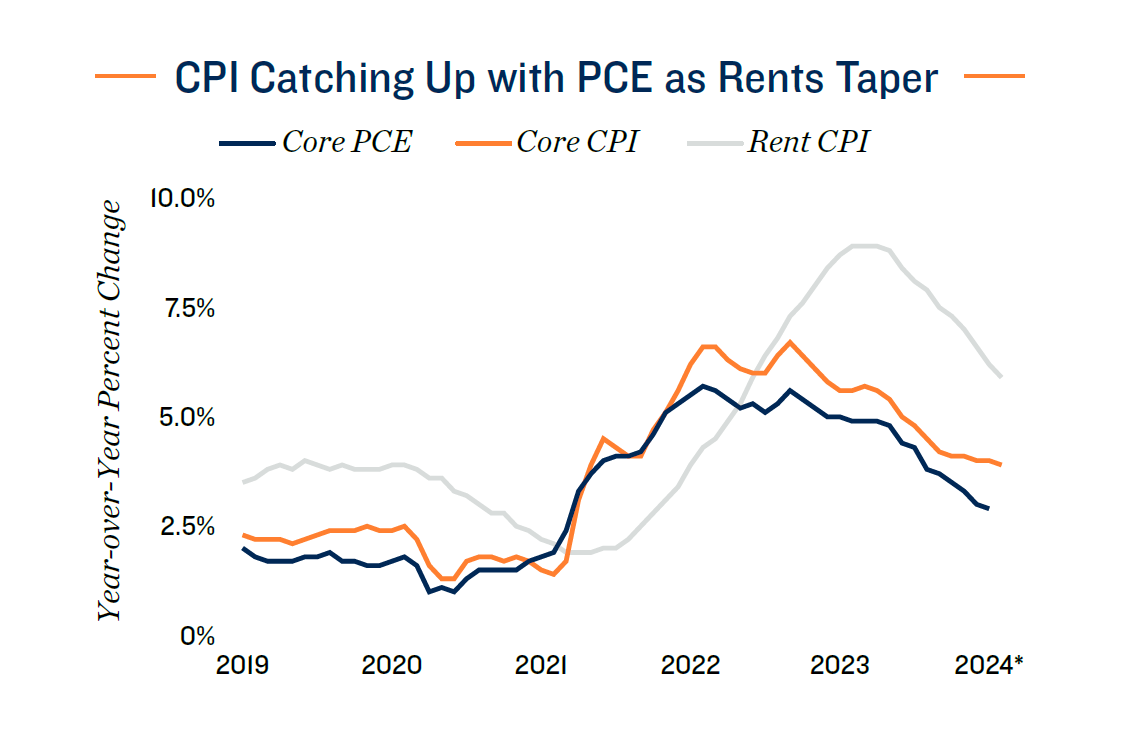

Inflation trends cloud Fed’s path. Still-elevated inflation is leading Wall Street participants to delay expectations for the Federal Reserve to start cutting interest rates this year — shifting from spring to summer. Alongside strong hiring in the opening months of 2024, February’s higher headline CPI reading contributed to the Federal Open Market Committee’s decision to hold the federal funds rate at a 5.25 percent lower bound in March. Fortunately, core CPI, which strips out the more volatile food and energy indices, cooled year-over-year for 11 straight months through February 2024, marking the longest uninterrupted period of disinflation since 1975. Even as headline inflation remains bumpy, lessening core pricing pressures should enable…

Download